Crude Cool-Off: Why Oil Prices Are Tumbling in Mid-February 2026

The “fear premium” that pushed oil prices toward $75 last month is rapidly dissolving. As of Friday, February 13, 2026, global benchmarks are on track for a significant weekly retreat. While traders were braced for a Middle Eastern flare-up just days ago, the narrative has shifted toward a massive supply surplus and a surprising diplomatic […] The post Crude Cool-Off: Why Oil Prices Are Tumbling in Mid-February 2026 first appeared on Business League.

The “fear premium” that pushed oil prices toward $75 last month is rapidly dissolving. As of Friday, February 13, 2026, global benchmarks are on track for a significant weekly retreat. While traders were braced for a Middle Eastern flare-up just days ago, the narrative has shifted toward a massive supply surplus and a surprising diplomatic opening between Washington and Tehran.

Also Read |Tamil Nadu Voter List Purge: 97 Lakh Names Deleted in SIR Phase 1

Market Breakdown: Brent and WTI Hit Two-Week Lows

Early Friday trading showed a cautious but downward trajectory for the world’s most watched crude grades.

-

Brent Crude: Fell to 67.46, representing a weekly drop of 0.8%.

-

WTI (US Oil): Slipped to 62.72, down 1.1% for the week.

-

The “Bear” Signal: This follows a massive 8.5 million barrel build in U.S. crude inventories reported on Thursday, which caught analysts by surprise and signaled that domestic supply is outpacing current refinery demand.

The “Trump Factor”: From Carrier Deployments to Deal-Making

The primary driver of this week’s volatility was the mixed messaging from the White House. Earlier in the week, President Trump threatened Iran with a second aircraft carrier deployment and “very traumatic” consequences—a reference to Operation Midnight Hammer (the June 2025 strikes on Iranian nuclear sites).

However, on Thursday, February 12, Trump pivoted, telling reporters that he believes a deal can be reached “over the next month.” This shift from “Phase Two” (military escalation) to “Phase One” (negotiations) immediately sent traders into profit-taking mode, as the risk of a Strait of Hormuz closure appeared to recede.

Also Read |Tamil Nadu Voter List Purge: 97 Lakh Names Deleted in SIR Phase 1

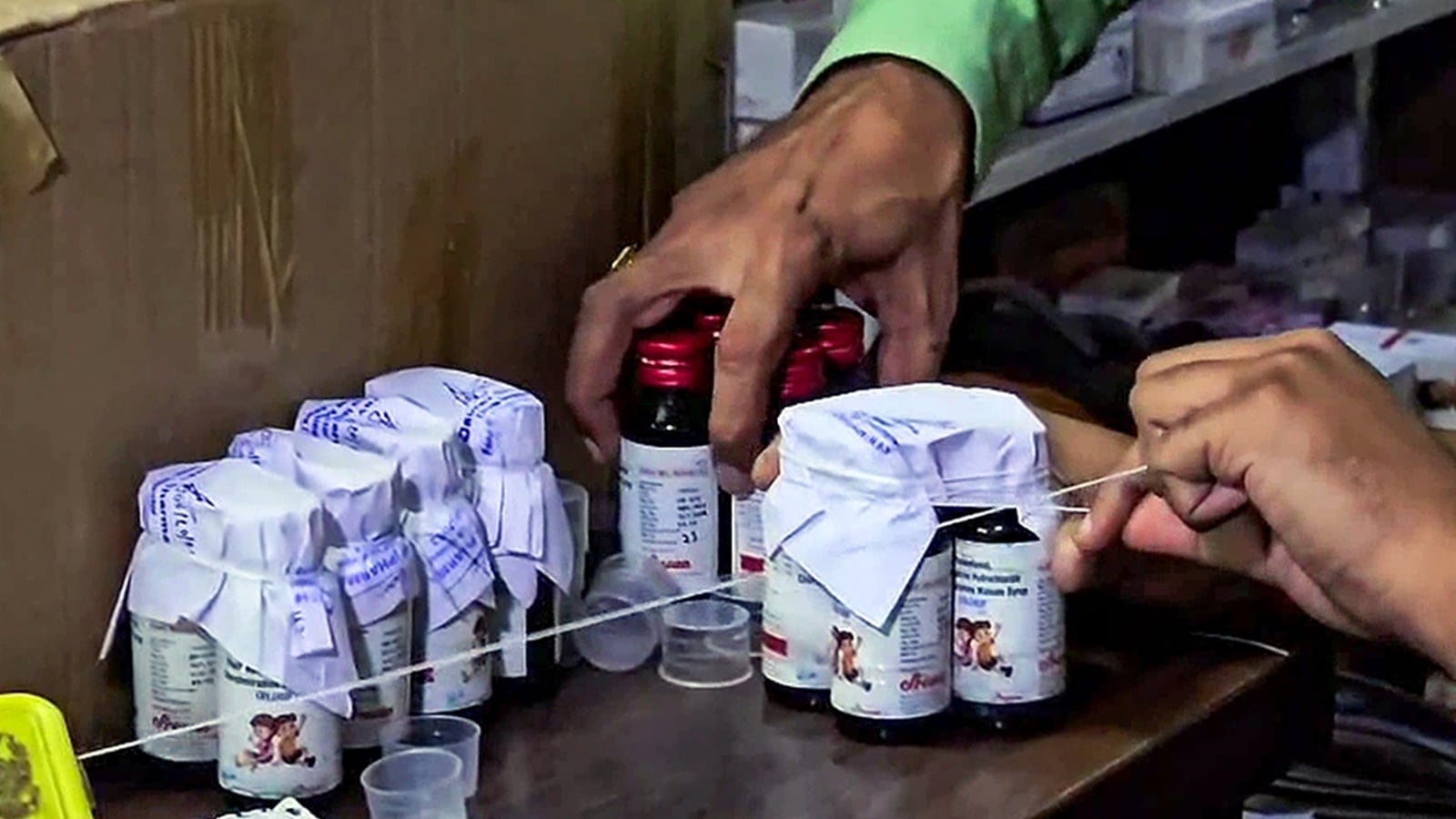

The Venezuela Pivot: Rebuilding an Energy Giant

While the Middle East calms, South America is revving up. U.S. Energy Secretary Chris Wright is currently on a historic three-day visit to Caracas, marking the highest-level U.S. energy mission to Venezuela in nearly 30 years.

-

Sanction Relief: The U.S. Treasury has issued General Licenses 46 and 47, allowing American firms like SLB and Halliburton to resume exploration and production.

-

Production Goals: Analysts expect Venezuelan output to jump from 880,000 bpd to 1.2 million bpd in the coming months.

-

The “Energy Deal”: Under the new U.S.-Venezuela framework, oil sales have already generated over $1 billion in controlled accounts, with $5 billion more expected by mid-summer to fund infrastructure repairs.

IEA Outlook: Oversupply Fears Dominate 2026

The International Energy Agency (IEA) added further pressure on Thursday by slashing its global demand growth forecast.

-

The Cut: Growth is now projected at 850,000 bpd, down from the previous 930,000 bpd estimate.

-

The Surplus: Assuming OPEC+ maintains its current output, the IEA warns of a 3.7 million bpd surplus by the end of the year.

-

Inventory Peaks: Global inventories rose by 37 million barrels in December alone, reaching levels not seen since the 2020 pandemic lockdowns.

Also Read |Tamil Nadu Voter List Purge: 97 Lakh Names Deleted in SIR Phase 1

[OIL MARKET SNAPSHOT: FEB 13, 2026]

| Indicator | Current Value | Weekly Change | Impact Level |

| Brent Crude | $67.46 | -0.8% |  Bearish Bearish |

| U.S. Inventories | 428.8M bbl | +8.5M bbl |  Bearish Bearish |

| Venezuela Output | 0.88M bpd | Increasing |  Bearish Bearish |

| IEA Forecast | 850k bpd | -83k bpd |  Bearish Bearish |

Next Steps

If you are an energy sector investor, you should watch for the official venue announcement for the U.S.-Iran talks, as any delay in the “one-month” timeline could trigger a sharp price rebound. Furthermore, if you are monitoring the impact on fuel prices, you should expect a 2–3% drop at the pump by next week if Brent remains below the $68 support level.

Also Read |Tamil Nadu Voter List Purge: 97 Lakh Names Deleted in SIR Phase 1

End…

The post Crude Cool-Off: Why Oil Prices Are Tumbling in Mid-February 2026 first appeared on Business League.

What's Your Reaction?