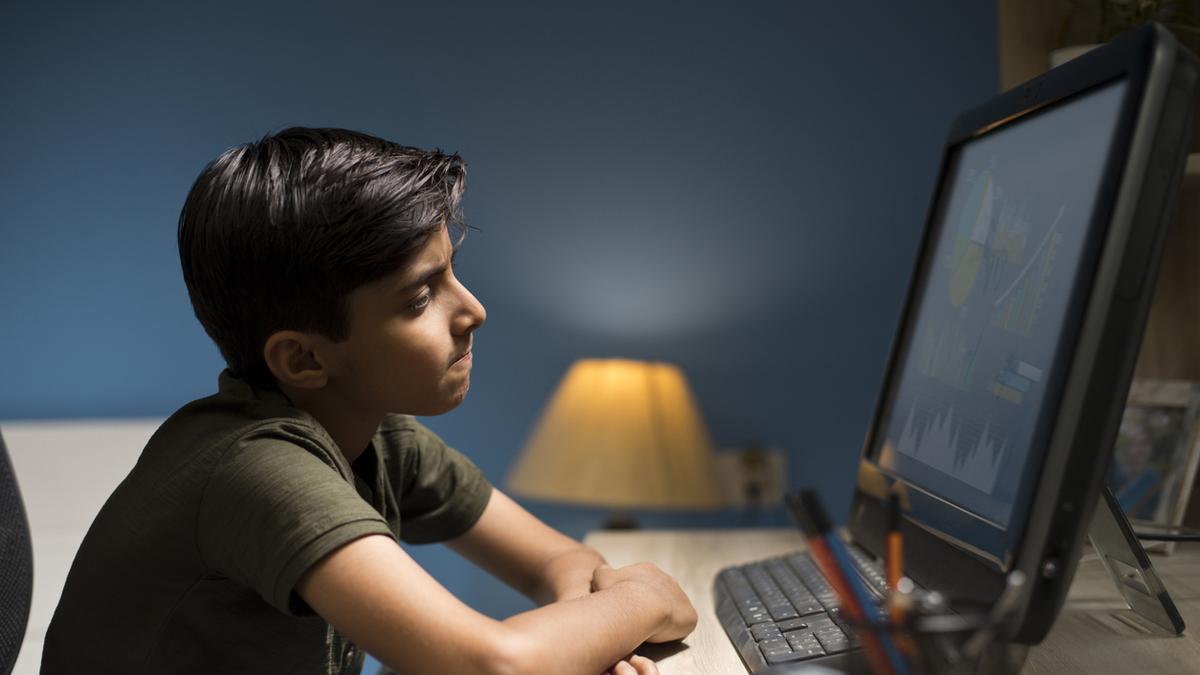

Australian banks passed interest rate hikes on to mortgage holders – so why haven’t they done so for savings accounts?

There’s an obvious reason for the delay. But the banks still need to compete on savings rates to finance their operationsFollow our Australia news live blog for latest updatesGet our breaking news email, free app or daily news podcastShortly after the Reserve Bank lifted the official cash rate by a quarter of a percentage point, major lenders announced interest rates on mortgages would rise by the same amount.Yet the interest rates that can grow their customer’s savings accounts are still “under review” – or the increases are being applied selectively – days after Tuesday’s announcement. Continue reading...

There’s an obvious reason for the delay. But the banks still need to compete on savings rates to finance their operations

Get our breaking news email, free app or daily news podcast

Shortly after the Reserve Bank lifted the official cash rate by a quarter of a percentage point, major lenders announced interest rates on mortgages would rise by the same amount.

Yet the interest rates that can grow their customer’s savings accounts are still “under review” – or the increases are being applied selectively – days after Tuesday’s announcement. Continue reading...

What's Your Reaction?