Dubai 2026–2028: Glut or Opportunity? What the Incoming Wave of Residential Handovers Really Means for Investors

Dubai’s real estate market has been on a historic bull run. For the past five years, it has been a story of soaring property prices in Dubai, record-breaking foreign investment, and skyrocketing rental rates. However, a new market driver is set to define the Dubai property market 2026–2028: a massive influx of new housing supply largely from off-plan properties, many of which haven’t reached completion yet. Understanding […] The article Dubai 2026–2028: Glut or Opportunity? What the Incoming Wave of Residential Handovers Really Means for Investors appeared first on Arabian Post.

Dubai’s real estate market has been on a historic bull run. For the past five years, it has been a story of soaring property prices in Dubai, record-breaking foreign investment, and skyrocketing rental rates. However, a new market driver is set to define the Dubai property market 2026–2028: a massive influx of new housing supply largely from off-plan properties, many of which haven’t reached completion yet.

Understanding how this “delivery pipeline” will be absorbed by buyer and tenant demand is now the critical factor in assessing investment attractiveness in Dubai real estate. What follows is a concise, fact-based analysis of the situation, likely scenarios, key numbers to watch, and practical steps for property investors in Dubai.

The Situation: Scale of Supply and Current Dynamics

A Significant Supply Influx

Dubai’s residential pipeline for 2025–2028 is estimated to contain between 200,000 and 300,000 new units (apartments and villas). Consultancy firms like Knight Frank report hundreds of thousands of units under construction and scheduled for delivery by 2029, with independent analyses confirming a mid-term range of approximately 260,000–303,000 units entering the Dubai housing market.

Peak Concentration in 2026–2027

A large number of projects launched during the 2020–2023 boom are slated for completion in 2026–2027, creating a pronounced peak in handovers during this window. Market reviews consistently point to the middle of the decade as the anticipated high-water mark for new residential supply in Dubai.

Current Market Indicators

Until mid-2025, the market saw rapid price appreciation and rental growth, with Dubai becoming one of the world’s most expensive rental markets. However, even during this growth, rating agencies began flagging the risk of a price correction due to the impending wave of new inventory.

Key Metrics to Watch

- Estimated Supply (2025–2028): 200,000 – 300,000 residential units (subject to construction delays and project reshuffling). When analyzed year by year, the number of delivered projects peaked in 2025, and upcoming supply graphs show a 2–3 fold leap compared to past years.

- Potential Price Correction: Analysts at Fitch have modeled scenarios suggesting price declines of up to 10–15% in 2025–2026, contingent on a supply surge and slowdown in foreign purchases.

- Average Gross Rental Yields in Dubai: City-wide yields range from 5–7%, with pockets in areas like JVC and Arjan reaching 8–9%. Premium locations such as Palm Jumeirah and Downtown Dubai offer lower yields of 4–6%. These figures are crucial for calculating mortgage servicing costs and ROI.

- Demographic Demand Drivers: Dubai’s population has grown to approximately 4 million, with tourism and residency initiatives (Golden Visa, D33 economic agenda) sustaining demand. This helps absorb supply but doesn’t eliminate the risk of localized oversaturation.

“Let’s keep in mind the global context we’re living in today. The world is going through a period of instability, multiple conflicts, shifting values, and recurring economic crises. Many people in Europe and the U.S. are feeling the pressure of rising taxes and uncertainty.

In contrast, the UAE has become a true safe haven for those looking to protect their assets and secure a stable future for their families. This is driving not only the migration of people but also a significant flow of capital into the UAE, and particularly into Dubai,” – says Artem Dzis, Dubai real estate investment expert.

Plausible Scenarios and Their Impact

Scenario A. The Soft Landing

- Conditions: Demand continues to grow due to immigration, tourism, and corporate relocations. Some projects face delays, and the premium segment remains resilient.

- Outcome: A minimal price correction (0–5%), with stable or rising rents in prime locations. This presents short-term buying opportunities on the secondary market.

- Ideal For: Long-term, capital-growth-focused investors with diversified portfolios, especially in high-demand segments like studios and one-bedroom apartments.

Scenario B. The Price Correction (Analysts’ Base Case)

- Conditions: The 2026–2027 handover peak creates short-term oversupply, particularly in the mass-market apartment segment.

- Outcome: An average market price decline of 10–15%, with localized rental adjustments in saturated communities. Premium locations are expected to hold value better.

- Impact: Challenging for short-term speculators; an opportunity for cash-rich buyers to consolidate assets at a discount ahead of a recovery, which has historically taken 2–4 years in previous Dubai real estate cycles.

Scenario C. Structural Renaissance

- Conditions: Government intervention to manage supply, coupled with economic diversification (D33, developer consolidation), and job growth in high-value sectors.

- Outcome: Demand absorbs supply efficiently. Prices experience a soft correction or plateau, while rental yields remain stable.

The Investor’s Stress Test: A Practical Calculation

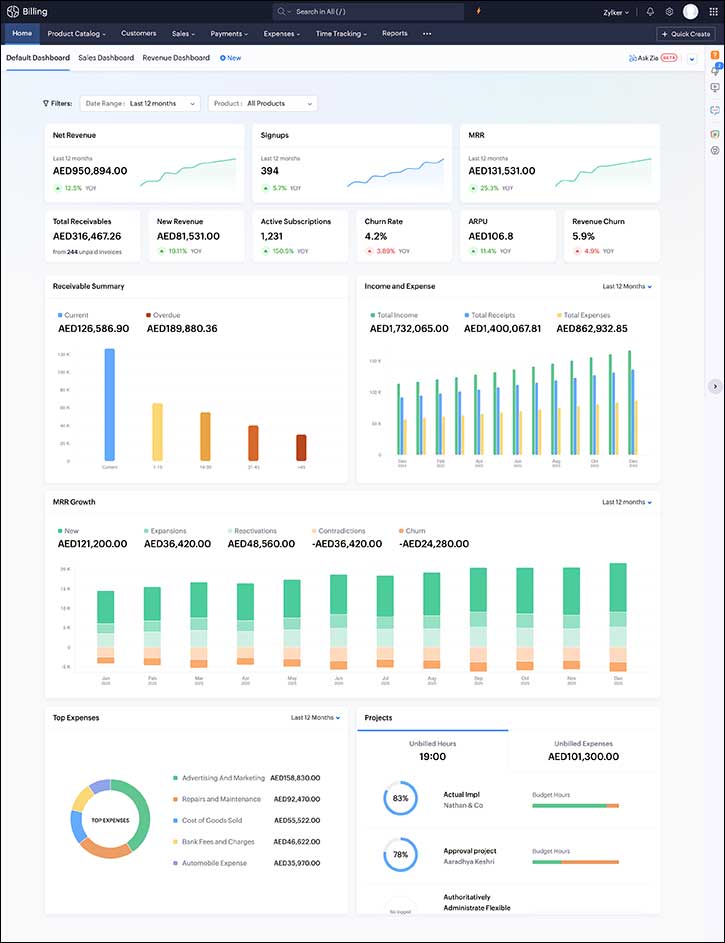

Here are some calculations that Colife did. Assume a property is purchased for AED 1,000,000, generating AED 60,000 in annual rent (a 6.0% gross yield).

- If price falls 15% (to AED 850,000) but rent stays the same: Yield = 7.06% (better for a holder, worse for a seller).

- If price falls 15% and rent falls 10% (to AED 54,000): Yield = 6.35% (manageable, but liquidity decreases).

- If price falls 15% and rent falls 20% (to AED 48,000): Yield = 5.65% (signals compression, risk for leveraged investors).

Takeaway: A price drop alone isn’t catastrophic if rental income covers expenses. The real risk is a simultaneous decline in both price and rent.

“Before drawing conclusions, it’s important to distinguish ready properties from off-plan projects, as the latter will be most affected.

Ready properties are already priced by real end-user demand, so a major drop is unlikely. Off-plan units, however, have seen artificial price growth over the past four years, making many of today’s handovers overpriced compared to the ready market.

Investors who bought at higher levels now face unrealistic ROI expectations, and some may be unable or unwilling to complete final payments, leading to resales below original prices.

Overall, oversupplied areas without strong community appeal will feel the pressure most, while mid-range areas may stagnate temporarily, and premium villa and townhouse communities should continue to appreciate due to limited supply,” – says Artem Dzis.

Action Plan: 10 Strategic Recommendations for Dubai Real Estate Investors

- Diversify by Location: Premium (Downtown, Palm) and established areas show stronger resilience.

- Focus on Cash Flow: Target gross rental yields equal to or greater than 6–7%.

- Run a Stress Test: Model a 10–15% price drop and 10% rental decline.

- Stick with Reputable Developers.

- Be Cautious with Overvalued Off-Plan Projects.

- Check Project Timing: Avoid overlap with mass handovers.

- Use Short-Term Lets as a Hedge: Dubai’s tourism supports short-term rentals.

- Maintain Liquidity: Keep 6–12 months of expenses in reserve.

- Conduct Thorough Due Diligence: Legal checks, service charges, rental rules.

- Monitor Regulatory Changes: Visa, mortgage, and rental law reforms can reshape demand.

To Sell or To Hold?

If you invested before 2023, your asset has likely appreciated. If your plan was to resell, now may be a good time to exit — prices may still rise but at a slower pace as demand spreads. It could be wise to hold liquidity for future discounted purchases, expected to appear over the next 2–3 years.

“For more recent investments, I’d recommend holding until handover, then renting out either monthly or annually to secure a 5–6% net return, while waiting for a stronger resale opportunity,” – says Artem Dzis.

Final Verdict: A Manageable Threat and a Tangible Opportunity

The upcoming wave of Dubai residential handovers (2026–2028) is neither a crisis nor a guaranteed windfall. It represents a market evolution — from post-pandemic scarcity to competitive maturity.

While analysts warn of a 10–15% correction in a worst-case scenario, premium properties and well-managed rental assets are expected to retain their appeal.

For pragmatic investors, the current cycle calls for discipline over speculation: stress-test portfolios, reduce leverage where possible, and focus on assets with proven rental demand and strong long-term fundamentals.

The article Dubai 2026–2028: Glut or Opportunity? What the Incoming Wave of Residential Handovers Really Means for Investors appeared first on Arabian Post.

What's Your Reaction?