India-US Trade Deal: Deven Choksey on Market Winners & Risks | Live

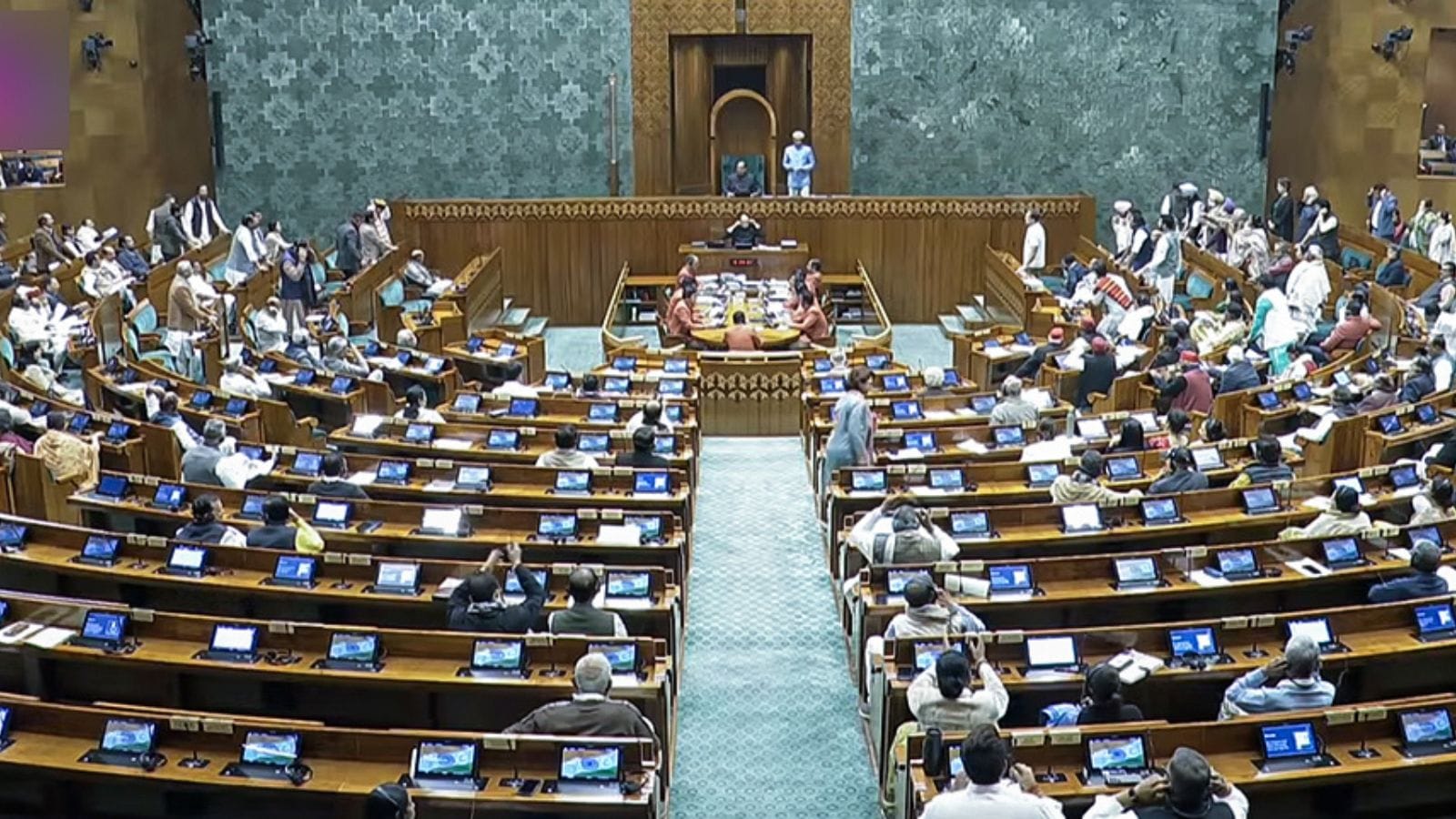

In Business Today's Market Commentary, Shailendra Bhatnagar discusses the explosive rally following the late-night US-India trade deal announcement on February 2, 2026. US President Donald Trump and PM Narendra Modi confirmed a pact slashing US tariffs on Indian exports from 50% (25% reciprocal + 25% punitive for Russian oil buys) to 18% effective immediately, in exchange for India halting Russian oil imports and boosting US purchases (energy, agriculture, tech). Devan Choksi (MD, Dr Choksi Finserv) views it as a landmark $500B bilateral deal, building on recent FTAs (EU, UAE, etc.), positioning India for $1T exports. He ties it to Budget 2026's 20-22 year tax holiday for data centers, rare earth corridors, semiconductors, and GCC incentives (safe harbor rates), fueling AI/digital economy growth from $400B to $2T in a decade. Market surge: Nifty up ~700 points, Bank Nifty +1,500; realty/auto sectors +3-5%. Key beneficiaries: IT/GCCs (AI integration, large orders), chemicals (3 zones for global standards), textiles (parks, competitive tariffs vs. China/Vietnam), auto ancillaries (ADAS, exports), power/renewables (data center ecosystem, green hydrogen). Long-term: manufacturing revival, lower power costs, multi-bagger potential in construction/real estate. Optimistic outlook-wait for clarity on fine print.

In Business Today's Market Commentary, Shailendra Bhatnagar discusses the explosive rally following the late-night US-India trade deal announcement on February 2, 2026. US President Donald Trump and PM Narendra Modi confirmed a pact slashing US tariffs on Indian exports from 50% (25% reciprocal + 25% punitive for Russian oil buys) to 18% effective immediately, in exchange for India halting Russian oil imports and boosting US purchases (energy, agriculture, tech). Devan Choksi (MD, Dr Choksi Finserv) views it as a landmark $500B bilateral deal, building on recent FTAs (EU, UAE, etc.), positioning India for $1T exports. He ties it to Budget 2026's 20-22 year tax holiday for data centers, rare earth corridors, semiconductors, and GCC incentives (safe harbor rates), fueling AI/digital economy growth from $400B to $2T in a decade. Market surge: Nifty up ~700 points, Bank Nifty +1,500; realty/auto sectors +3-5%. Key beneficiaries: IT/GCCs (AI integration, large orders), chemicals (3 zones for global standards), textiles (parks, competitive tariffs vs. China/Vietnam), auto ancillaries (ADAS, exports), power/renewables (data center ecosystem, green hydrogen). Long-term: manufacturing revival, lower power costs, multi-bagger potential in construction/real estate. Optimistic outlook-wait for clarity on fine print.

Economist Admin

Admin managing news updates, RSS feed curation, and PR content publishing. Focused on timely, accurate, and impactful information delivery.