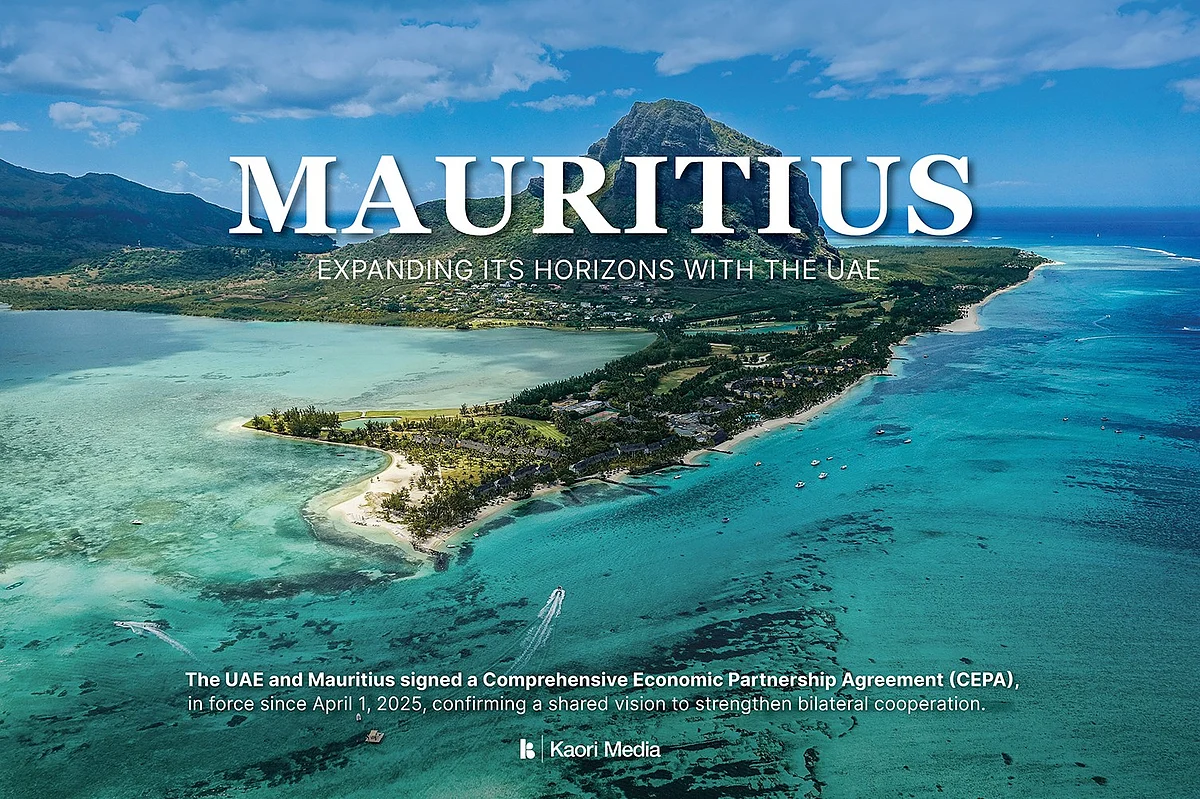

Mauritius: Expanding its horizons with the UAE

Once best known for its pristine beaches and luxury resorts, Mauritius has, over the past three decades, steadily positioned itself as one of Africa’s most dynamic hubs for investment, finance and high-value tourism, driven by long-term policy vision, strategic partnerships and a rapidly evolving financial services ecosystem. Today, the island state is consolidating its role as a leading international financial centre at the intersection of Africa, the Gulf and Asia.This evolution has gained renewed momentum with the entry into force of the UAE–Mauritius Comprehensive Economic Partnership Agreement (CEPA) on April 1, 2025. As the UAE’s first CEPA with an African country, the agreement marks a strategic milestone in Gulf–Africa relations and reflects a shared ambition to deepen economic cooperation across trade, investment, finance, tourism and technology. A future-oriented national visionAt the heart of Mauritius’s long-term strategy is Vision 2050, a national roadmap designed to position the country among advanced economies by mid-century. Rather than a static policy document, Vision 2050 is conceived as a living framework responding to global uncertainty, technological disruption and climate challenges.The strategy prioritises future-facing sectors such as artificial intelligence, fintech, digital services, medical sciences, renewable energy, and the blue and green economies. These growth pillars are reinforced by a strong emphasis on governance, skills development, social inclusion and fiscal sustainability, ensuring that economic progress remains competitive, resilient and broadly shared.For international investors, this clarity of direction provides long-term confidence. Mauritius combines political stability, transparent institutions and an investment-grade financial ecosystem with an increasingly innovation-driven growth model.CEPA: Unlocking Gulf–Africa opportunityThe UAE–Mauritius CEPA is projected to more than double non-oil bilateral trade, from approximately $210 million to $500 million within five years. Under the agreement, Mauritius will eliminate 99 per cent of tariffs on UAE imports, while the UAE will remove 97 per cent overall, significantly improving market access for goods and services.Beyond tariffs, the CEPA strengthens cooperation in investment facilitation, digital trade, logistics, tourism and technology. For Gulf investors, it reinforces Mauritius’s role as a stable, well-regulated platform for accessing African markets. For Mauritius, it deepens engagement with one of the world’s most dynamic commercial hubs.This bilateral framework is further enhanced by Mauritius’s membership in regional blocs including SADC, COMESA and the African Union, as well as its participation in the African Continental Free Trade Area (AfCFTA), potentially opening access to a pan-African market of over 1.3 billion people. A trusted international financial centreFinancial services remain a cornerstone of the Mauritian economy, contributing over 13 per cent of GDP and anchoring the island’s role as an international financial centre. Mauritius combines a robust regulatory framework, a hybrid legal system blending Common Law and Civil Law traditions, and an extensive network of double taxation avoidance agreements with more than 40 countries.Ongoing reforms, digitalisation and strict adherence to global compliance standards continue to reinforce investor trust. At the same time, the ecosystem is evolving toward higher-value activities, including fund management, fintech, sustainable finance and cross-border structuring for Africa-focused investments.This balance between regulatory credibility and commercial agility has positioned Mauritius as one of Africa’s most globally connected and reputable financial hubs, particularly attractive to Gulf institutions seeking transparent and efficient access to emerging markets.Tourism, sustainability and diversificationWhile diversifying rapidly, tourism remains a vital pillar of the economy. In 2025, Mauritius welcomed approximately 1.44 million visitors, generating more than $2.1 billion in revenues. The focus is increasingly on high-value segments such as luxury hospitality, wellness, eco-tourism and integrated resort developments aligned with sustainability goals.Beyond tourism and finance, Mauritius is expanding into renewable energy, smart agriculture, aquaculture, life sciences and advanced manufacturing, reinforcing economic resilience while supporting climate and food security objectives. A compelling partner for Gulf investorsWith strong air connectivity, cultural openness, bilingual business environments and a skilled workforce, Mauritius offers Gulf investors a rare combination of stability, sophistication and regional reach. The country’s strategic location in the Indian Ocean, coupled with its legal certainty and international partnerships, positions it as a natural bridge between the UAE, Africa and global markets.As economic ties between Mauritius and t

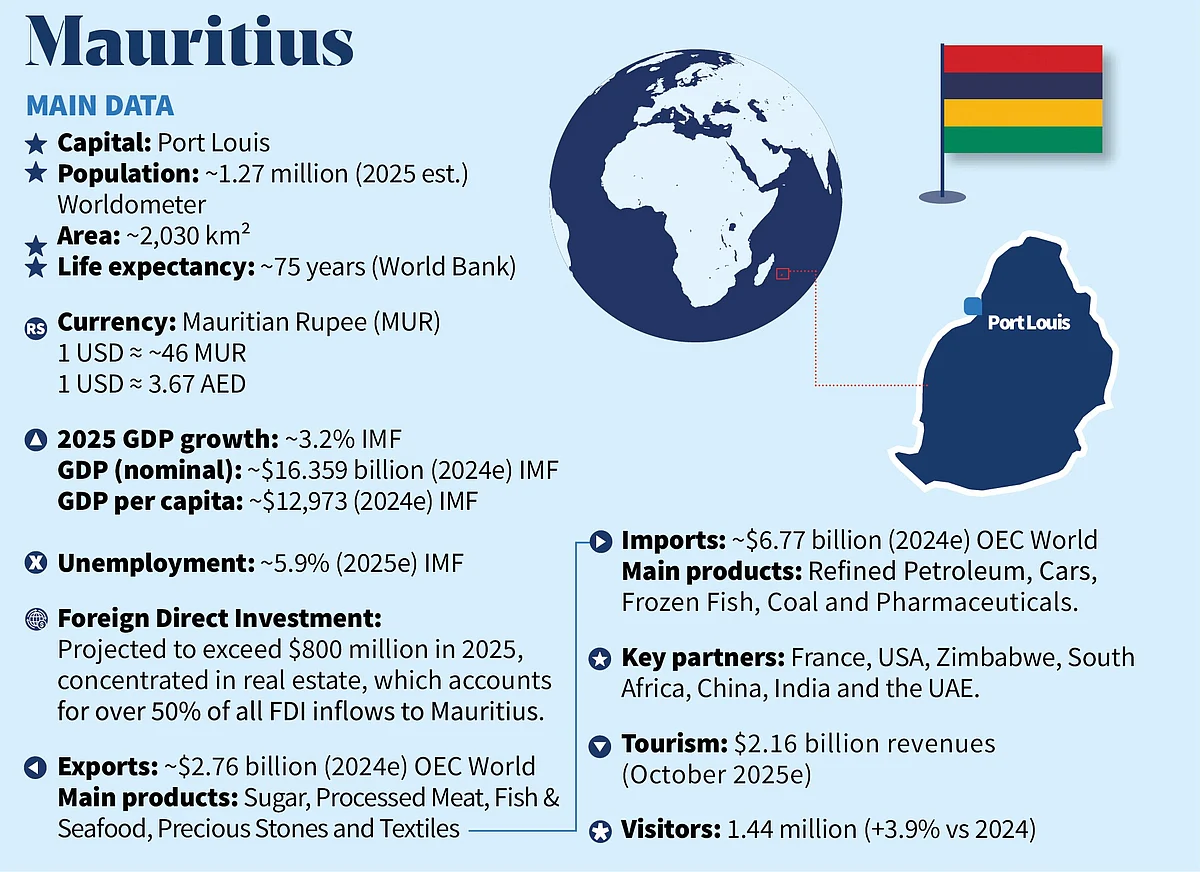

Once best known for its pristine beaches and luxury resorts, Mauritius has, over the past three decades, steadily positioned itself as one of Africa’s most dynamic hubs for investment, finance and high-value tourism, driven by long-term policy vision, strategic partnerships and a rapidly evolving financial services ecosystem. Today, the island state is consolidating its role as a leading international financial centre at the intersection of Africa, the Gulf and Asia.

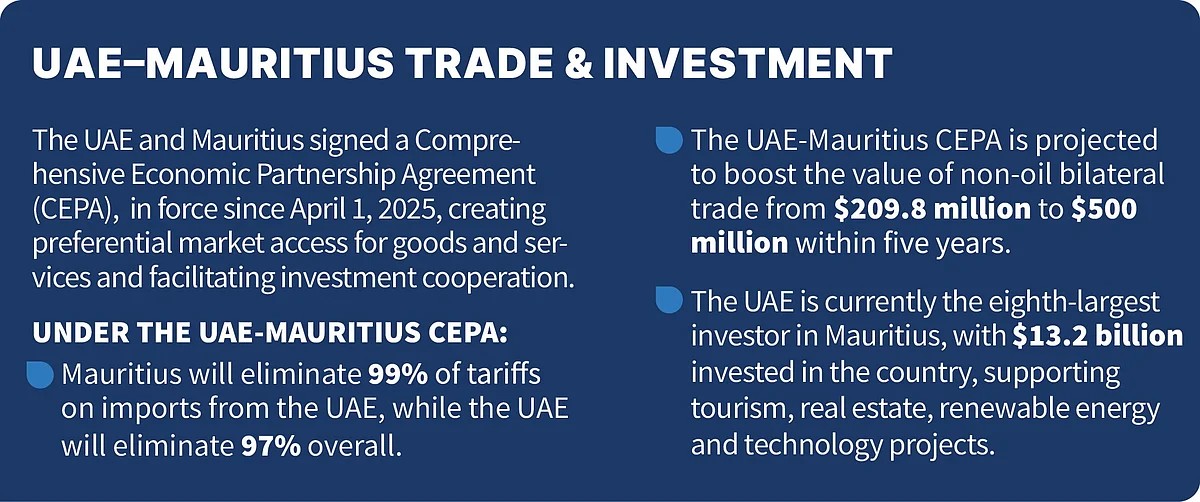

This evolution has gained renewed momentum with the entry into force of the UAE–Mauritius Comprehensive Economic Partnership Agreement (CEPA) on April 1, 2025. As the UAE’s first CEPA with an African country, the agreement marks a strategic milestone in Gulf–Africa relations and reflects a shared ambition to deepen economic cooperation across trade, investment, finance, tourism and technology.

A future-oriented national vision

At the heart of Mauritius’s long-term strategy is Vision 2050, a national roadmap designed to position the country among advanced economies by mid-century. Rather than a static policy document, Vision 2050 is conceived as a living framework responding to global uncertainty, technological disruption and climate challenges.

The strategy prioritises future-facing sectors such as artificial intelligence, fintech, digital services, medical sciences, renewable energy, and the blue and green economies. These growth pillars are reinforced by a strong emphasis on governance, skills development, social inclusion and fiscal sustainability, ensuring that economic progress remains competitive, resilient and broadly shared.

For international investors, this clarity of direction provides long-term confidence. Mauritius combines political stability, transparent institutions and an investment-grade financial ecosystem with an increasingly innovation-driven growth model.

CEPA: Unlocking Gulf–Africa opportunity

The UAE–Mauritius CEPA is projected to more than double non-oil bilateral trade, from approximately $210 million to $500 million within five years. Under the agreement, Mauritius will eliminate 99 per cent of tariffs on UAE imports, while the UAE will remove 97 per cent overall, significantly improving market access for goods and services.

Beyond tariffs, the CEPA strengthens cooperation in investment facilitation, digital trade, logistics, tourism and technology. For Gulf investors, it reinforces Mauritius’s role as a stable, well-regulated platform for accessing African markets. For Mauritius, it deepens engagement with one of the world’s most dynamic commercial hubs.

This bilateral framework is further enhanced by Mauritius’s membership in regional blocs including SADC, COMESA and the African Union, as well as its participation in the African Continental Free Trade Area (AfCFTA), potentially opening access to a pan-African market of over 1.3 billion people.

A trusted international financial centre

Financial services remain a cornerstone of the Mauritian economy, contributing over 13 per cent of GDP and anchoring the island’s role as an international financial centre. Mauritius combines a robust regulatory framework, a hybrid legal system blending Common Law and Civil Law traditions, and an extensive network of double taxation avoidance agreements with more than 40 countries.

Ongoing reforms, digitalisation and strict adherence to global compliance standards continue to reinforce investor trust. At the same time, the ecosystem is evolving toward higher-value activities, including fund management, fintech, sustainable finance and cross-border structuring for Africa-focused investments.

This balance between regulatory credibility and commercial agility has positioned Mauritius as one of Africa’s most globally connected and reputable financial hubs, particularly attractive to Gulf institutions seeking transparent and efficient access to emerging markets.

Tourism, sustainability and diversification

While diversifying rapidly, tourism remains a vital pillar of the economy. In 2025, Mauritius welcomed approximately 1.44 million visitors, generating more than $2.1 billion in revenues. The focus is increasingly on high-value segments such as luxury hospitality, wellness, eco-tourism and integrated resort developments aligned with sustainability goals.

Beyond tourism and finance, Mauritius is expanding into renewable energy, smart agriculture, aquaculture, life sciences and advanced manufacturing, reinforcing economic resilience while supporting climate and food security objectives.

A compelling partner for Gulf investors

With strong air connectivity, cultural openness, bilingual business environments and a skilled workforce, Mauritius offers Gulf investors a rare combination of stability, sophistication and regional reach. The country’s strategic location in the Indian Ocean, coupled with its legal certainty and international partnerships, positions it as a natural bridge between the UAE, Africa and global markets.

As economic ties between Mauritius and the UAE continue to deepen, the island is redefining itself not only as an exceptional destination to visit, but as an increasingly compelling place to invest, structure capital and build long-term partnerships linking the Gulf with Africa’s growth story.

Click here to download the 24 pages digital publication produced by Kaori Media: www.kaori-media.com/country-reports/mauritius

Companies and institutions in Mauritius exploring partnership opportunities with the UAE:

Banking:

Absa Mauritius

Banque Patronus

HSBC Mauritius

Mauritius Commercial Bank (MCB)

Standard Chartered Mauritius

Trade and Development Bank Group (TDB Group)

Construction and Real Estate

2Futures

Hyvec Group

Mirasi Group

MJ Développement

Ramasawny & Ramasawny Co Ltd (RRCL)

Financial Services:

Abler Group

Aureyva Wealth

Axis Fiduciary

Dentons Mauritius

Intercontinental Trust (ITL)

Intrasia Group

Trade and Logistics:

Mauritius Freeport Development (MFD)

Tourism and Wellness:

Centre de Chirurgie Esthétique de l'Océan Indien (CCEOI)

Le Jadis Beach Resort & Wellness

Maradiva Villas Resort & Spa

Mauritius Tourism and Promotion Agency (MTPA)

What's Your Reaction?