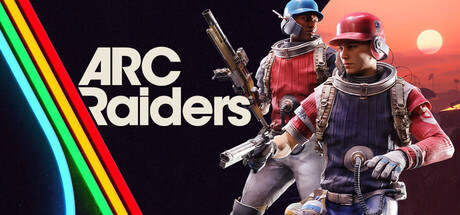

Nexon posts $3.1bn as Arc Raiders lifts growth

Nexon Co., Ltd. reported revenue of $3.1 billion for 2025, a 6.5 per cent increase on the previous year, marking its third consecutive year of record-breaking sales as strong performance from key titles, including the much-anticipated Arc Raiders, bolstered earnings. The Tokyo-listed gaming group said operating income also rose year on year, supported by sustained engagement across its core franchises and improved monetisation in overseas markets. Management […] The article Nexon posts $3.1bn as Arc Raiders lifts growth appeared first on Arabian Post.

Nexon Co., Ltd. reported revenue of $3.1 billion for 2025, a 6.5 per cent increase on the previous year, marking its third consecutive year of record-breaking sales as strong performance from key titles, including the much-anticipated Arc Raiders, bolstered earnings.

The Tokyo-listed gaming group said operating income also rose year on year, supported by sustained engagement across its core franchises and improved monetisation in overseas markets. Management attributed part of the uplift to steady demand for live-service titles and the commercial momentum building around Arc Raiders, a co-operative third-person shooter developed by Stockholm-based Embark Studios and published by Nexon.

Chief executive Lee Jung-hun said the company’s results reflected a “balanced portfolio strategy” and disciplined investment in new intellectual property alongside established brands. Nexon has long relied on flagship franchises such as Dungeon & Fighter and MapleStory, both of which continue to generate substantial recurring revenue through in-game purchases and seasonal content updates. Executives indicated that geographic diversification and stronger performance in North America and Europe helped offset softer trends in some Asian markets.

Arc Raiders, positioned as a premium live-service experience, has emerged as a central pillar of Nexon’s growth strategy. Industry analysts note that the title’s blend of cooperative gameplay and long-term content roadmap places it within a competitive but expanding segment of the global games market. Early player engagement metrics, according to company disclosures, exceeded internal projections, contributing to higher digital sales and ancillary revenue streams.

Global games industry revenue has stabilised following the volatility seen during the pandemic era, when lockdowns spurred exceptional demand. Market research firms estimate that worldwide games spending continues to grow at a modest pace, driven by digital distribution and cross-platform play. Nexon’s management said its focus on scalable online ecosystems has positioned the company to capture a larger share of player spending as competition intensifies.

Financial disclosures showed that PC and console revenues increased, reflecting a shift toward higher-value titles and international launches. Mobile performance remained resilient, though growth moderated compared with earlier cycles. Currency fluctuations had a limited impact on overall earnings, according to the company’s annual filing, with hedging strategies mitigating volatility in key markets.

Embark Studios, founded by former executives from DICE and known for its emphasis on advanced game technology, has been central to Nexon’s push into high-end Western markets. Nexon acquired a controlling stake in the studio to strengthen its global development footprint. Analysts say this strategy reduces reliance on domestic performance in South Korea and Japan, broadening exposure to Western audiences and diversifying risk.

Nexon’s capital allocation plan includes continued investment in new intellectual property, cloud infrastructure, and artificial intelligence tools aimed at enhancing player engagement and operational efficiency. Company officials have highlighted the role of data analytics in tailoring in-game content and improving user retention. Industry observers note that such tools are increasingly vital in a sector where player acquisition costs remain elevated.

Despite the upbeat earnings, competition across the sector remains intense. Major publishers are contending with rising development budgets, longer production cycles and evolving player expectations. Some analysts caution that sustaining double-digit growth in live-service titles requires continuous content updates and robust community management. Nexon executives acknowledged these pressures but said the company’s multi-year development pipelines and diversified portfolio provide resilience.

Share performance reflected investor confidence, with Nexon’s stock gaining ground following the earnings announcement. Market participants cited consistent revenue growth and disciplined cost control as factors underpinning the positive reaction. However, analysts continue to monitor macroeconomic headwinds that could influence discretionary consumer spending on digital entertainment.

Corporate filings indicate that Nexon maintained a strong balance sheet, with solid cash reserves enabling strategic acquisitions and development spending. Management signalled that further partnerships and studio investments remain under consideration as part of a broader global expansion strategy. Observers say this approach mirrors a wider consolidation trend within the games industry, where scale and intellectual property ownership are increasingly critical to long-term profitability.

The article Nexon posts $3.1bn as Arc Raiders lifts growth appeared first on Arabian Post.

What's Your Reaction?